Deferred Revenue Overview

How to use Translucent Deferred Revenue tool

With Translucent’s Deferred Revenue App, automate this process—ensuring release schedules align seamlessly with your accounting software. This guide will take you through each step, from setting up your accounts to posting your month-end journals, so you can manage deferred revenue with confidence and efficiency.

Step 1: Locate the Deferred Revenue app in the sidebar.

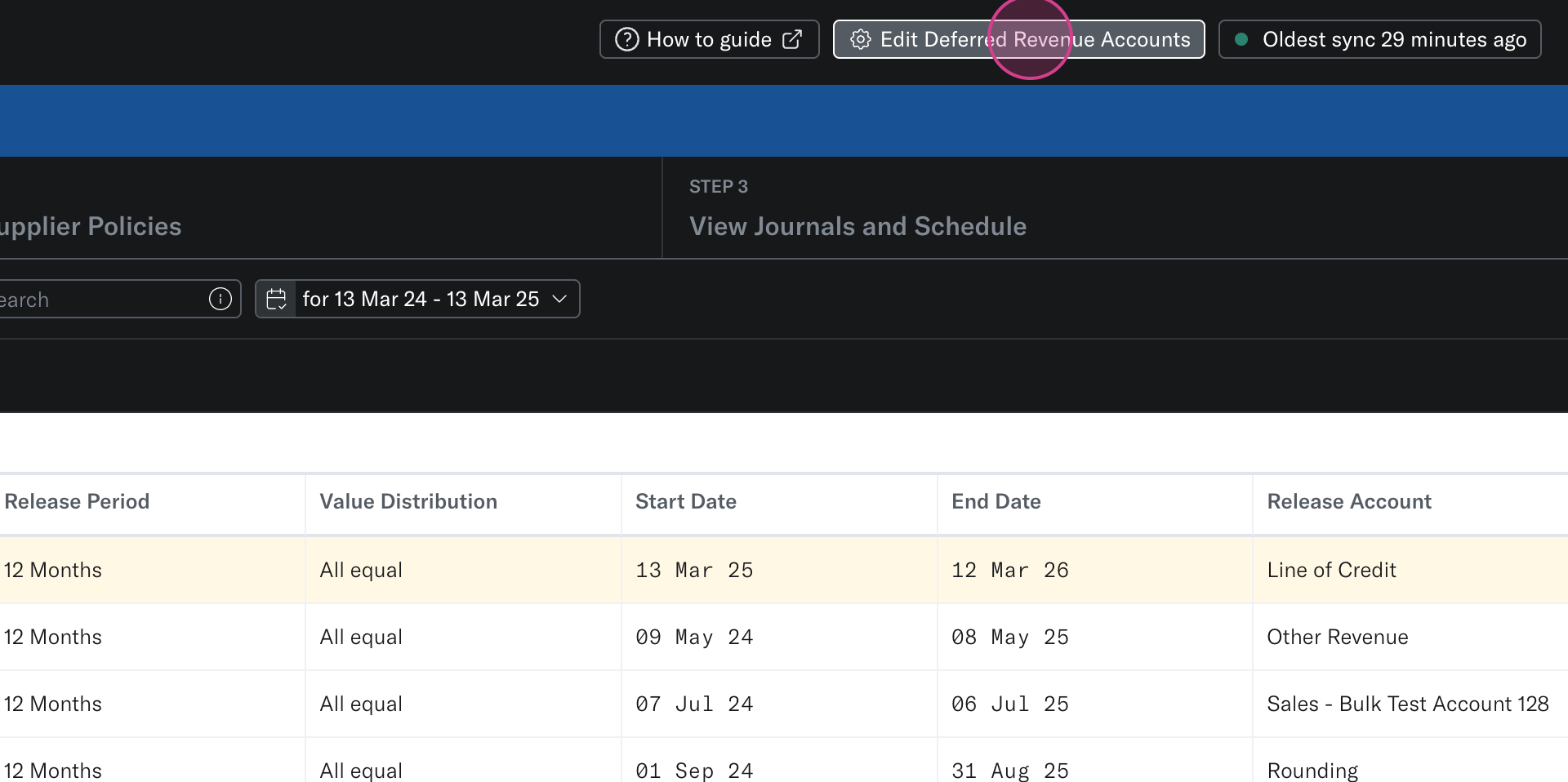

Step 2: Ensure your deferred revenue accounts are correctly mapped by Translucent. Accomplish this either on the Settings page or in the top right corner of any page in the Deferred Revenue Tools.

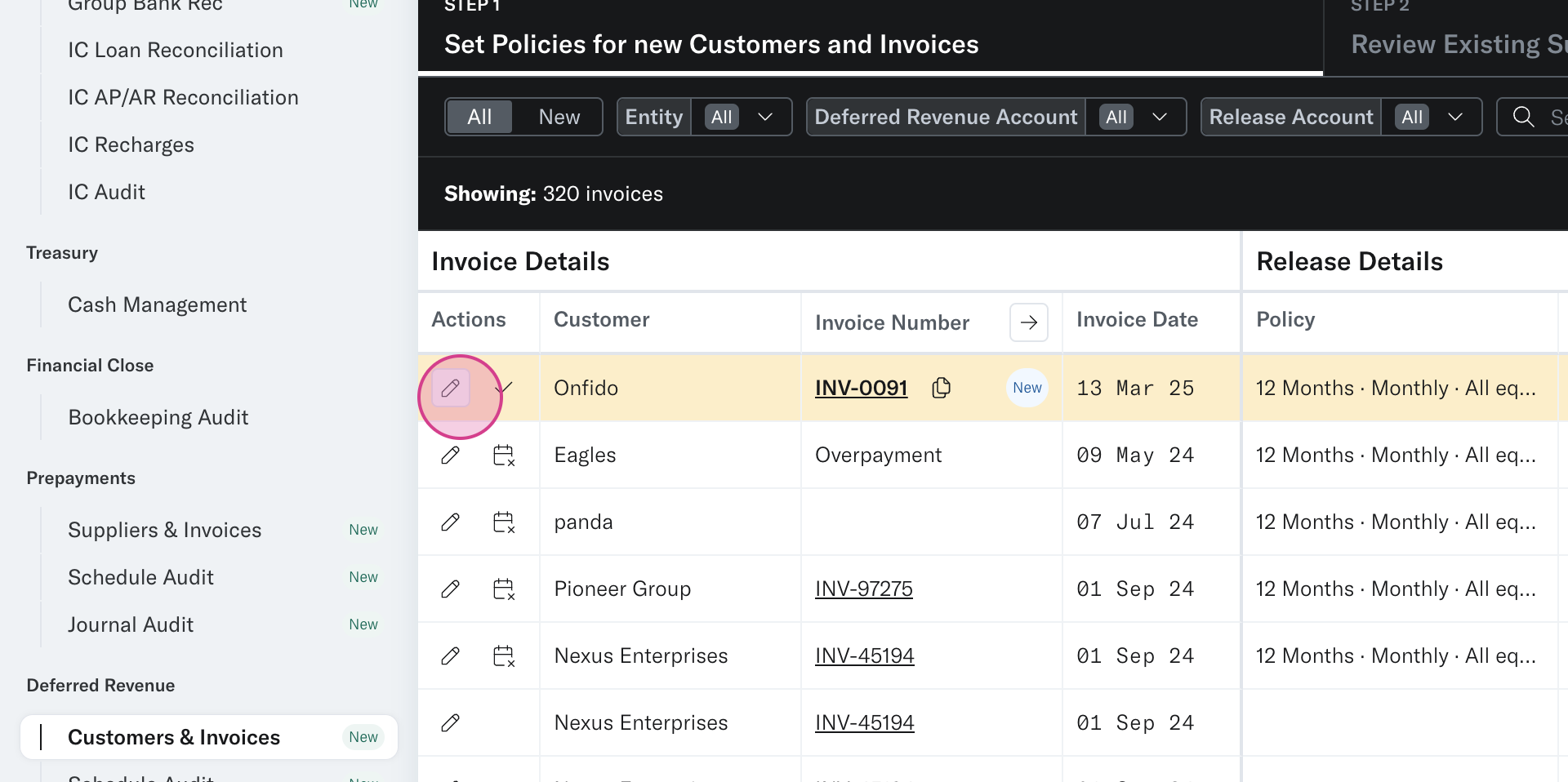

Step 3: Translucent will populate all relevant invoices that form part of your Deferred Revenue Accounts, flagging any new invoices as they’re entered into your accounting system. These new invoices are classified as either an existing customer with a new invoice or a new customer with a new invoice.

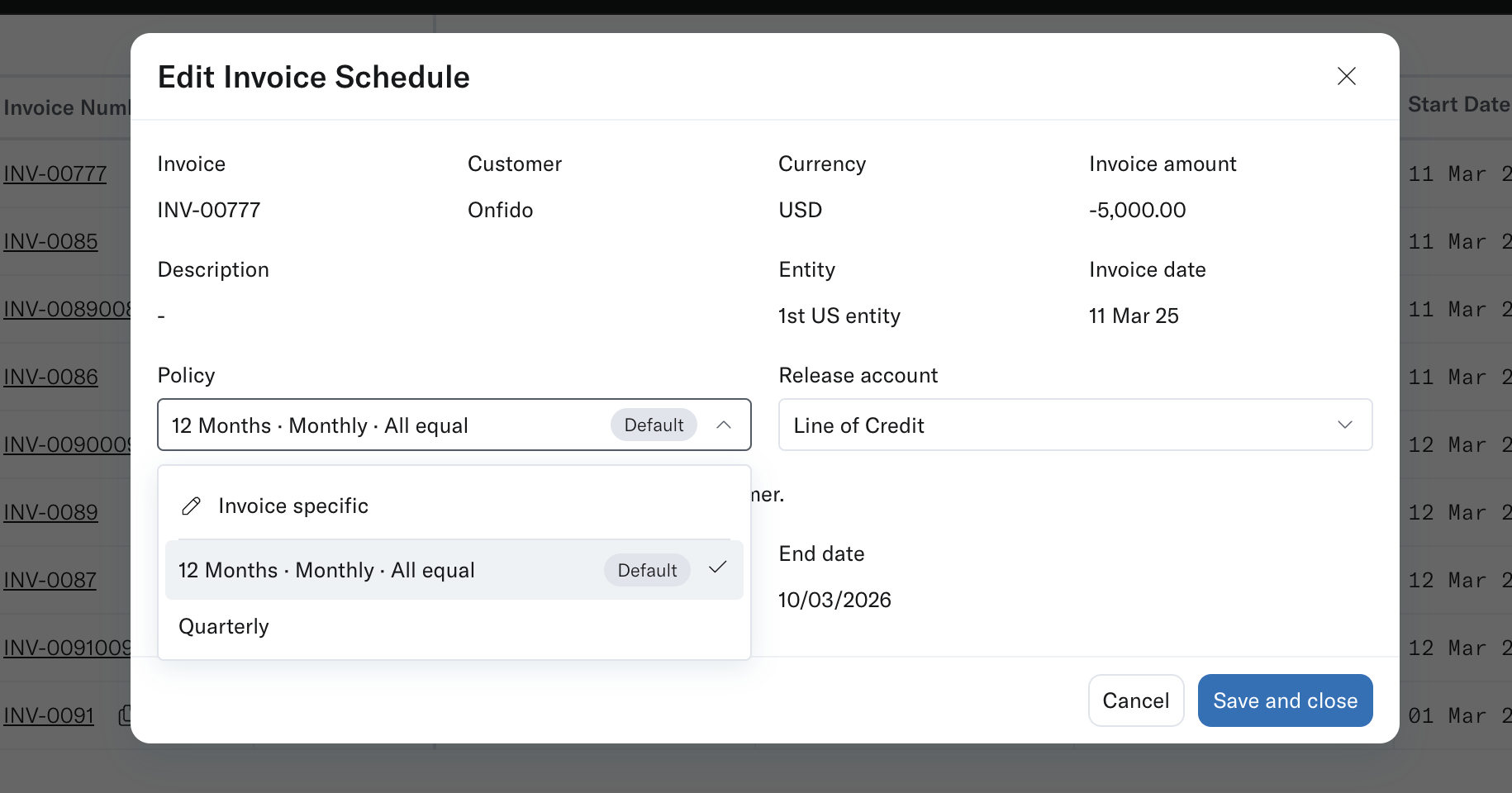

Step 4: If dealing with an existing customer, the new invoice will automatically apply their default policy. Edit the policy of the invoice or confirm it to include it in your schedule.

Step 5: For new invoices from new customers, Translucent automatically allocates the default policy. To align with how you want to distribute the prepaid expense, edit the:

- Policy

- Release Account

- Start Date

Step 6: Review, create, and allocate policies to your customers. Key areas of the policy are:

Release period - How many months do you want to release the prepayment over?

Value distribution - How do you want to distribute the value across your release period?

All Equal - Straightened across the period, or

Custom - Distribute the value based on when you receive the benefit from the supplier.

Once allocated, these policies will apply to all new invoices being entered into your Prepayment Accounts.

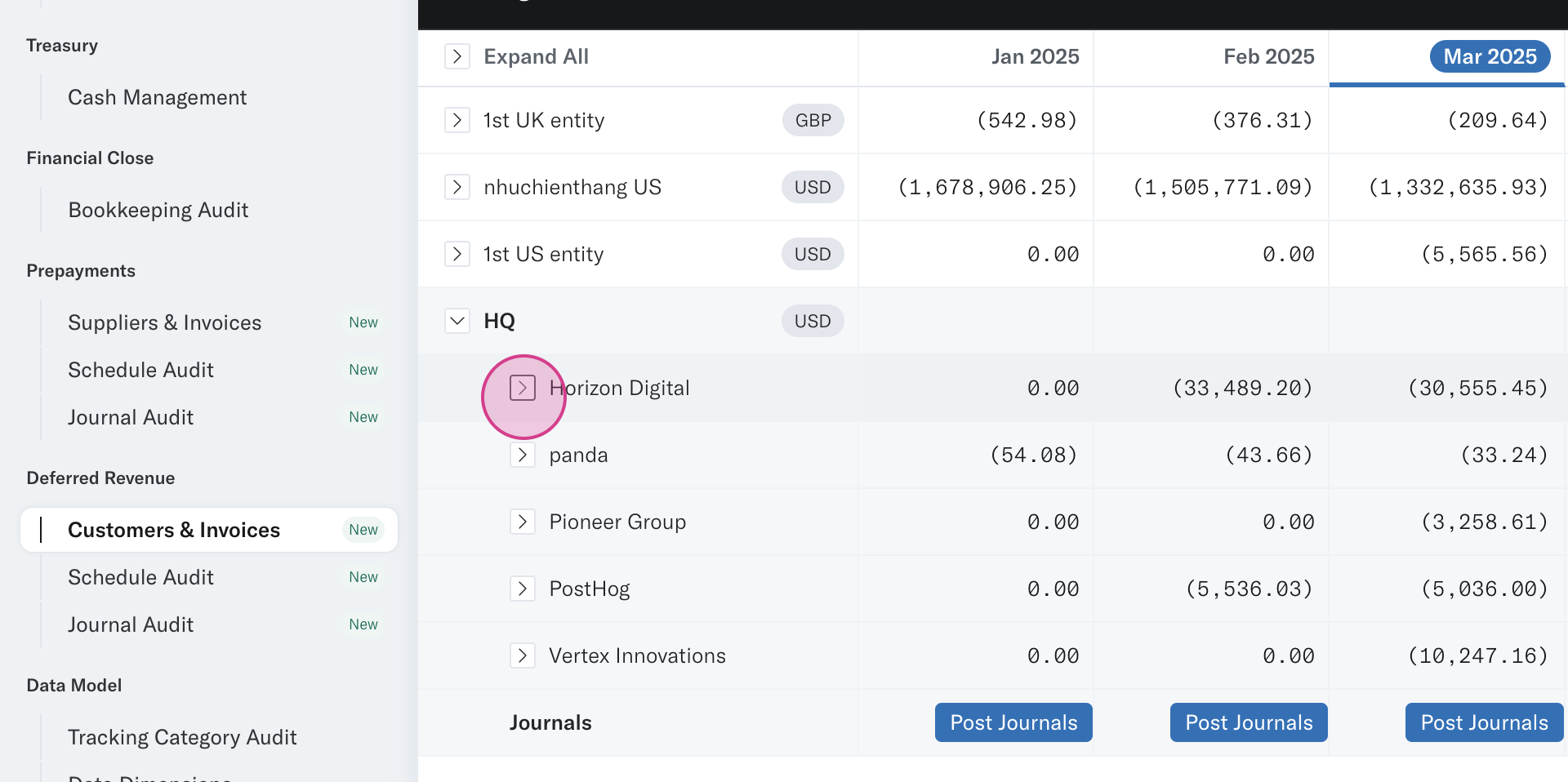

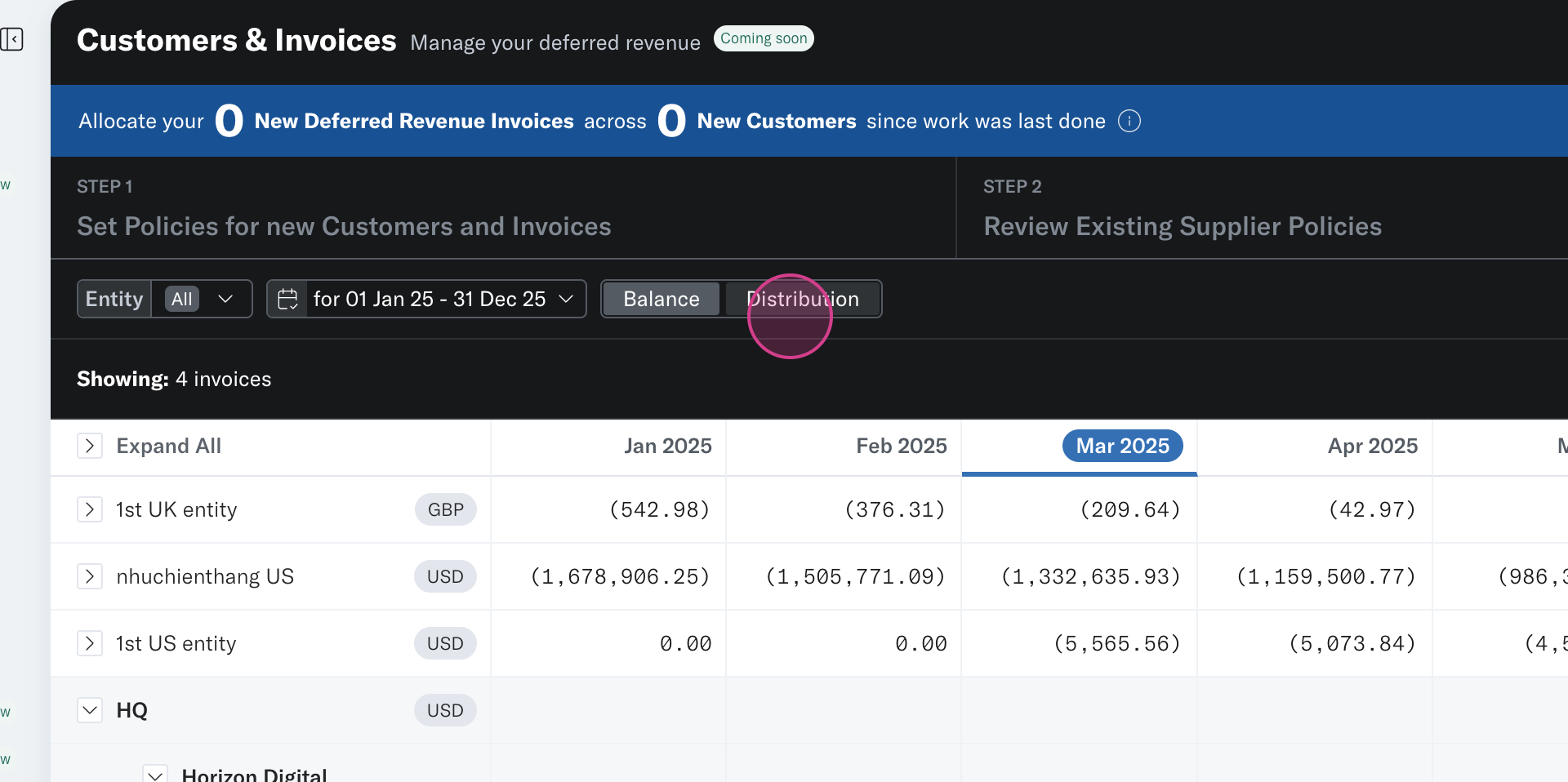

Step 7: In step 3 of the Invoices and Customer Tool, review the Deferred Revenue schedule based on the policies and release accounts allocated to your invoices. Schedules are grouped by entity and can be broken down on a customer/invoice level.

View your schedules on a balance basis or a distribution basis.

Step 8: If you want to make changes, edit the policies or schedules, or remove them completely. If any journals have been posted by Translucent, these will be reversed and reposted if necessary.

Step 9: When satisfied with the schedule, post the journals back to your accounting software.

Step 10: Drill down into the Journal Audit Tool to see all journals posted from the underlying source or from Translucent. You’ll also see customer names allocated to each journal, which should be helpful for variance analysis at the end of the month.

Step 11: If you prefer not to post journals, download your schedule in Excel to use within your existing workflow.

By following these steps, you’ll simplify deferred revenue management—automating your schedules, improving accuracy, and reducing manual effort.