Explainer of Exchange Rates

This is an explainer of how Exchange Rates (FX) work in Translucent. You can find Exchange Rates within Settings

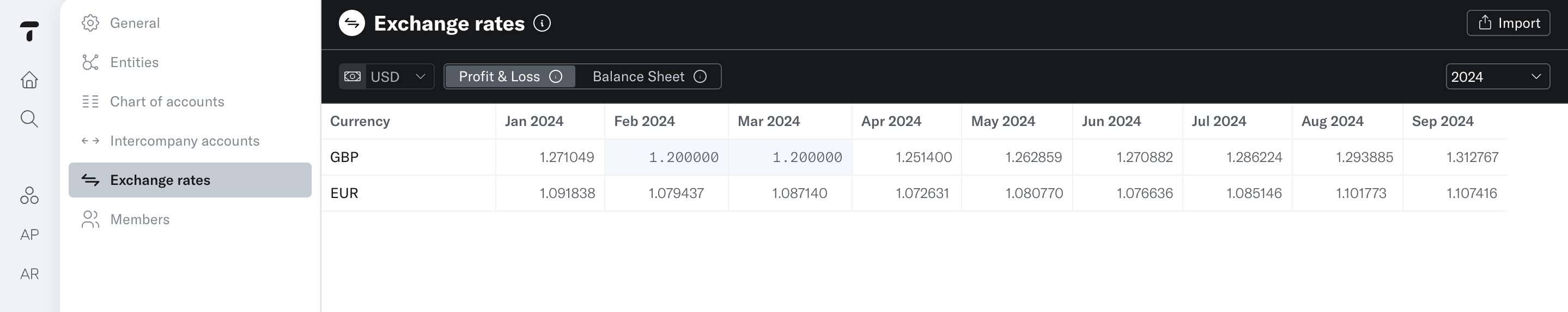

By default Translucent uses Open Exchange Rates to determine the applied exchange rate. In line with accounting standards, we distinguish between a profit and loss FX rate and a balance sheet FX rate.

Profit & Loss (P&L) Exchange Rates

For P&L calculations, Translucent employs a monthly average rate for all transactions and does not transfer the differences to an FX reserve.

Balance Sheet Exchange Rate

To account for any discrepancies at month-end if the balance sheet rate deviates from the average rate. The balance sheet rate is determined based on a fixed date at the end of the month, inevitably creating a distinction between the two rates.

FX differences between Xero and Translucent

The FX approach in Translucent contrasts with Xero’s calculation.

Xero translates each transaction at a precise minute rate and subsequently re-translating it at a daily rate, with the resulting differences being allocated to a temporary FX reserve.

Translucent converts the transaction based on the transaction date without revaluing on an ongoing basis.

If you want exact parity across reports you can utilize the "Xero Accurate FX" toggle by navigating to Further options > Xero Accurate FX.

Please note: this only works at month-end dates, as the Xero API exclusively supports month-end data retrieval.

Custom Exchange Rates

The platform offers flexibility in choosing any FX rate. By navigating to the settings, you can input custom FX rates of your preference for your Profit & Loss and Balance Sheet.